Autogenerate tax workflow using system intelligence built on a ‘Modern technology backbone’

Automated tax-workflow with built-in review process

Intelligently detect client action to autogenerate tasks

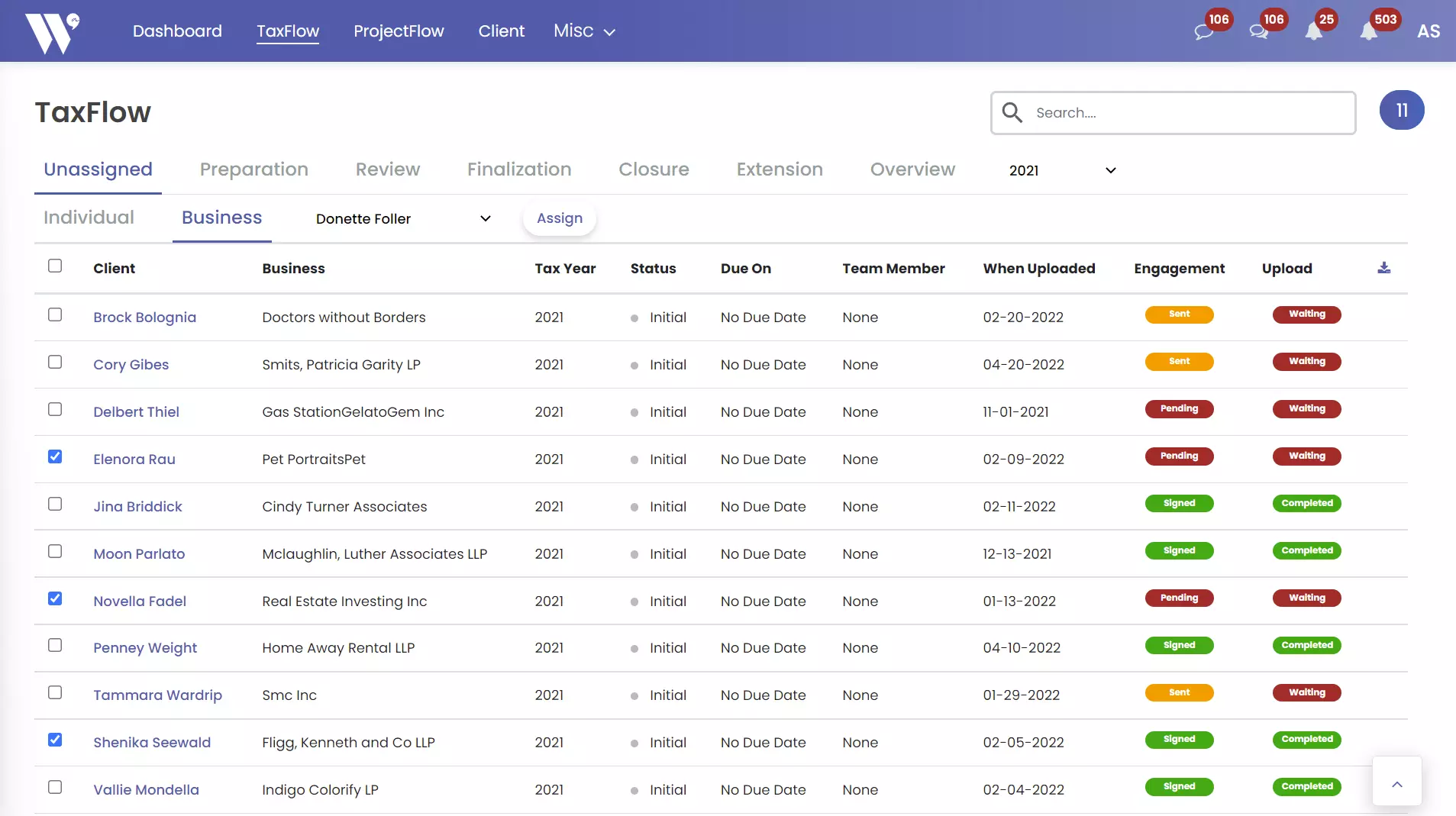

Tasks segregate and grouped as per tax-filing year and status

Track overdue / pending tasks alongwith overall Engagement status

Track and manage individual / business tax filing

How to use?

Once a client or a tax office staff uploads documents to prepare tax for a given financial year

The system detects a new file for a client or business intelligently and creates an unassigned task in the workflow

When a CPA or Admin or managers of a tax office login, they would see these unassigned worflow bucket

The task - individual or for a business, could be assigned to a team member

Once assigned, it is available in the team members workflow queue

The tax workflow automatically moves between various stakeholders based on the action performed

The various statuses for a tax workflow item are: Unassigned, Assigned, In Progress, Mgr Review, Admin Review, Client Review, Info Pending, Efile Auth, Efiled, Closed

This feature helps a tax office efficiently manage and track all the tax filing related workflow, especially during the "super busy" tax season

Built-in review mechanism to prevent omissions

Track file processing

Employee, Manager and CPA review

How to use?

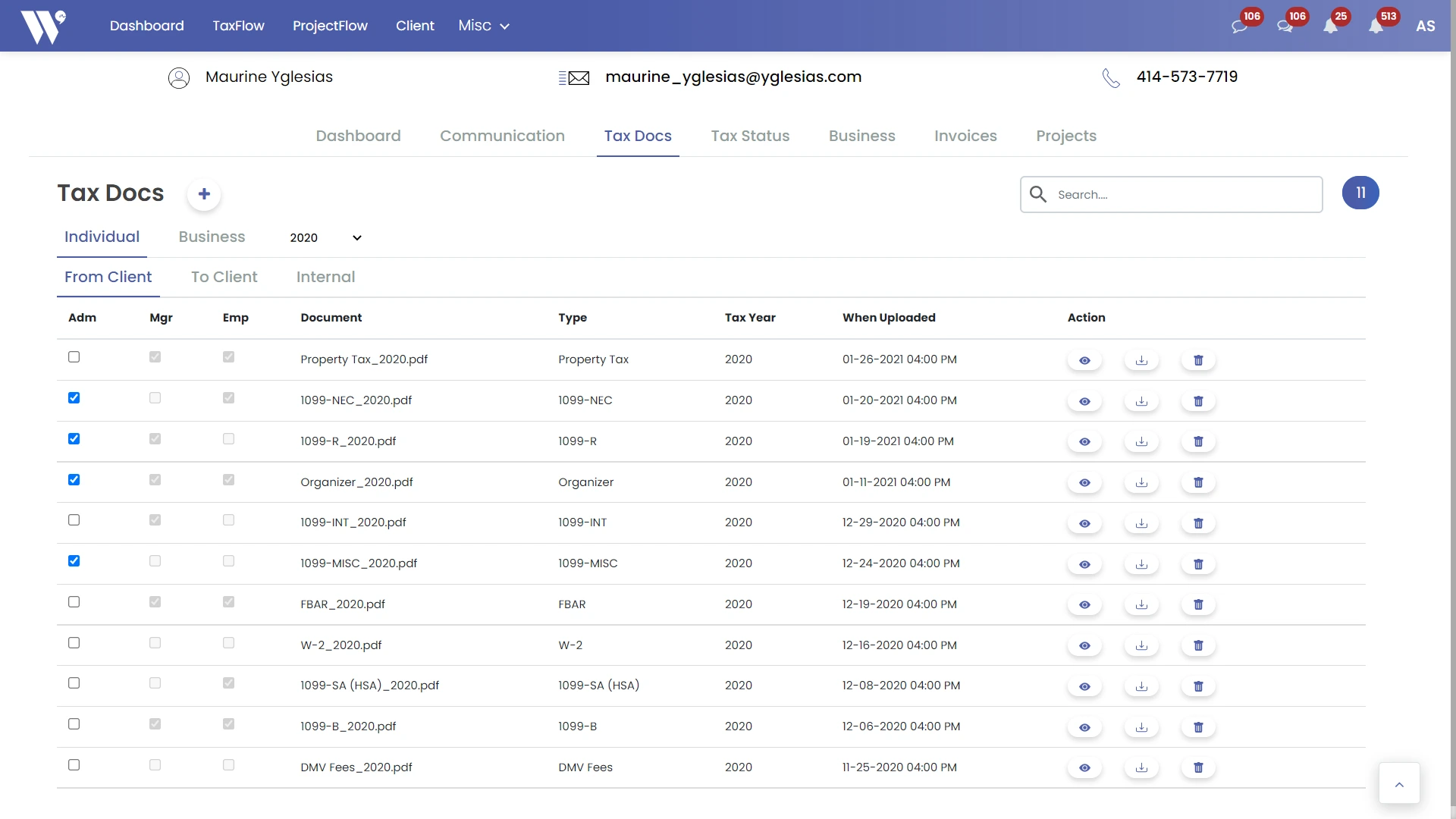

The tax workflow tasks flows from the head of the tax office to managers and to employee and back

Each stakeholder needs to ensure that they have done their due diligence on the documents received from the client

Each stakeholder has option to record their observations using the checkbox of the client's documents

This helps the reviewer to clearly see the documents that were considered for tax preparation

This also helps in easily identifying if any additional information is required from the client

© Copyright Intelligent Workspace. All Rights Reserved